The Health Insurance In Dallas Tx Statements

If you have any inquiries regarding insurance policy, call us as well as request a quote. They can assist you pick the appropriate policy for your requirements. Get in touch with us today if you want tailored solution from a licensed insurance policy agent - Life insurance in Dallas TX.

Here are a couple of factors why term life insurance policy is the most prominent kind. The cost of term life insurance policy premiums is figured out based on your age, wellness, and the protection quantity you call for.

With PPO plans, you pay greater monthly costs for the liberty to utilize both in-network and also out-of-network service providers without a recommendation. Paying a costs is comparable to making a regular monthly auto repayment.

An Unbiased View of Home Insurance In Dallas Tx

When you have a deductible, you are accountable for paying a specific amount for protection solutions before your health insurance plan provides protection. Life insurance policy can be separated into 2 main types: term as well as permanent. Term life insurance coverage gives insurance coverage for a certain duration, normally 10 to 30 years, as well as is more economical.

We can not prevent the unexpected from occurring, yet often we can safeguard ourselves and our households from the worst of the monetary results. Choosing the appropriate type and also amount of insurance is based upon your details situation, such as youngsters, age, lifestyle, and also employment advantages. Four kinds of insurance that the majority of monetary specialists suggest include life, health, car, and also long-lasting disability.

It consists of a survivor benefit and likewise a money worth component. As the value grows, you can access the cash by taking a car loan or taking out funds as well as you can end the policy by taking the money value of the policy. Term life covers you for a set amount of time like 10, 20, or thirty years and your costs continue to be secure.

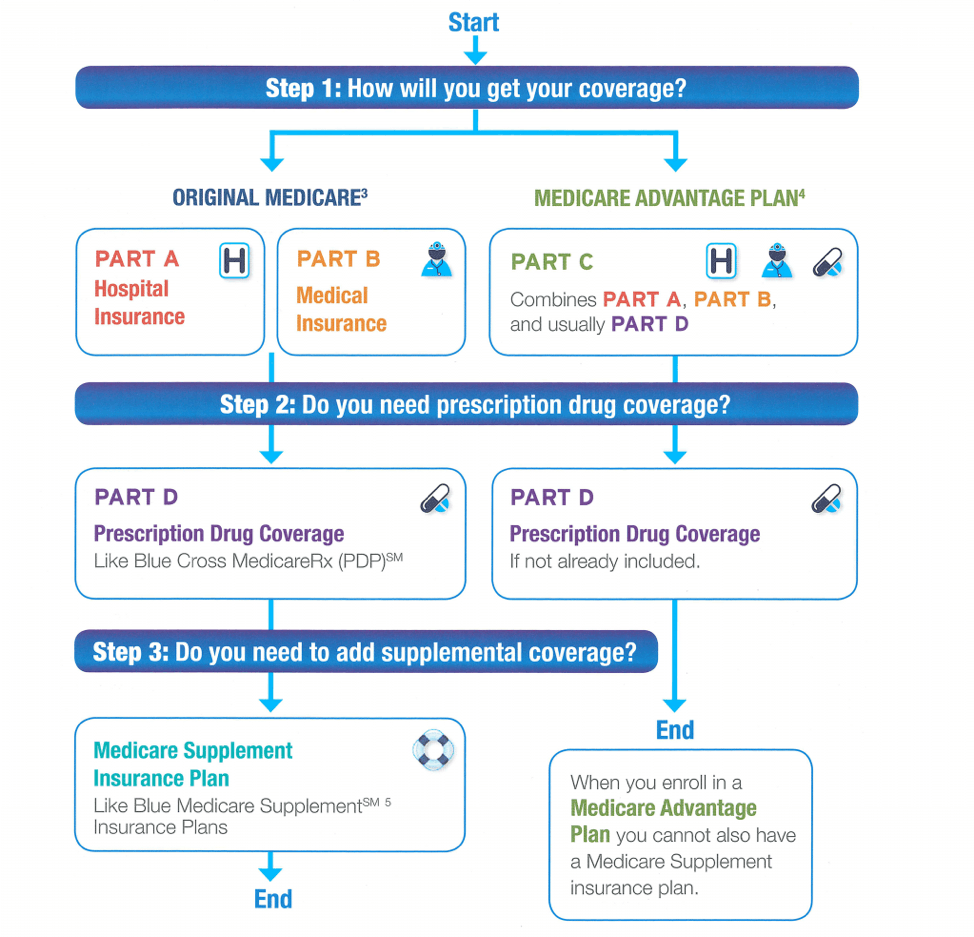

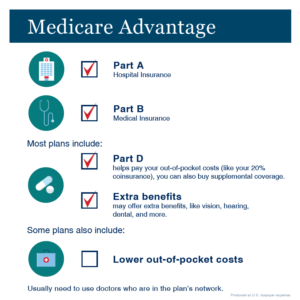

2% of the American populace was without insurance protection in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Health And Wellness Stats. Even more than 60% got their protection via an employer or in the personal insurance market while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' advantages programs, and the federal industry established under the Affordable Care Act.

The Truck Insurance In Dallas Tx Ideas

According to the Social Protection Administration, one in four workers entering the workforce will certainly become impaired before they get to the age of retirement. While health and wellness insurance pays over at this website for hospitalization as well as read review clinical bills, you are typically burdened with all of the expenses that your income had actually covered.

:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Mostly all states call for drivers to have auto insurance as well as the few that do not still hold chauffeurs economically responsible for any kind of damage or injuries they trigger. Here are your alternatives when buying automobile insurance coverage: Liability coverage: Spends for residential property damage and injuries you trigger to others if you're at fault for a crash and additionally covers litigation prices and judgments or negotiations if you're sued since of a cars and truck accident.

Company protection is commonly the ideal option, however if that is unavailable, get quotes from a number of suppliers as numerous provide discounts if you purchase even more than one sort of protection.

8 Simple Techniques For Life Insurance In Dallas Tx

, and how much you desire to pay for it., their pros as well as Insurance agency in Dallas TX disadvantages, how long they last, as well as who they're ideal for.

This is the most popular kind of life insurance policy for the majority of people because it's cost effective, just lasts for as long as you need it, and includes couple of tax obligation policies and also limitations. Term life insurance policy is one of the simplest as well as most affordable ways to supply an economic safeguard for your loved ones.

You pay premiums towards the plan, and also if you pass away during the term, the insurance provider pays a collection quantity of money, referred to as the death benefit, to your marked recipients. The death benefit can be paid as a swelling sum or an annuity. Many individuals choose to receive the survivor benefit as a lump amount to avoid paying tax obligations on any made passion. Life insurance in Dallas TX.